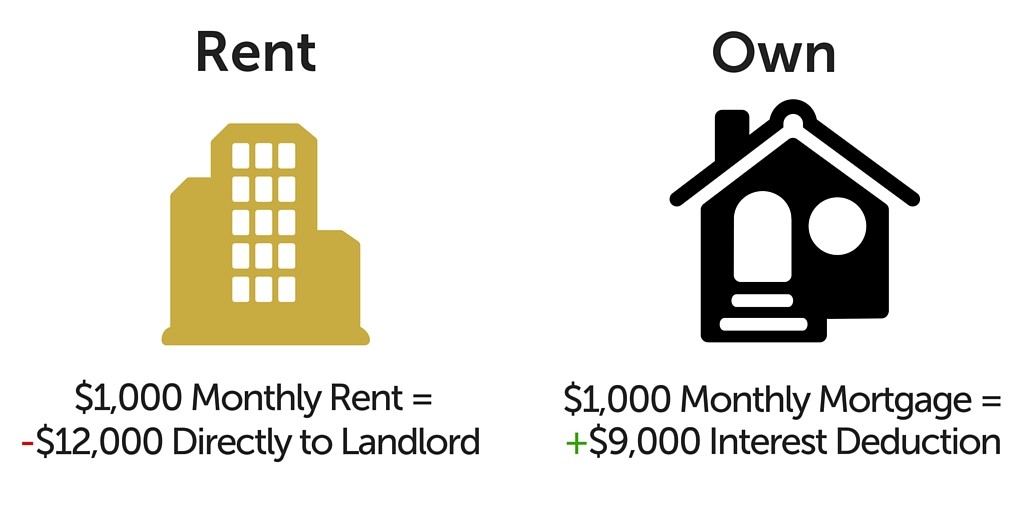

One of the strongest arguments for getting out of the rental pool is the taxable benefits of owning a home. Instead of the rent you pay going right into the landlord’s pocket every month, a portion of every mortgage payment is credited towards interest and property taxes paid each year. A taxpayer can deduct the mortgage interest and property taxes paid on his/her primary residence against his/her taxable income.

Here’s how it works.

1.Interest Deduction

One of the biggest benefits of home ownership is the ability to deduct mortgage interest you pay each year on your primary residence. As an example: A $200,000 30- year mortgage at 4.5% annual interest will accrue nearly $9,000 in interest over the course of the first year. This $9000 is deductible against ordinary income thereby reducing your taxable income and ultimately your federal taxes owed. Translating this into a benefit of home ownership: If you currently rent and pay $1000 per month that’s $12,000 per year going right into the landlord’s pocket with no financial benefit to you. If you could own for the same $1000 per month, you would be offsetting that $12,000 by $9000 interest deduction thereby lowering your housing costs to $3,000 ($12,000 - $9000).

2. Property Tax Deductions

In addition to mortgage interest deductions, home owners can usually deduct the amount paid for property taxes. Nevada is fortunate to have very low property tax rates when compared to other states. In Clark County Nevada, property tax rates are based on a percentage of the assessed value of the property. For arguments sake, let’s say the annual property taxes on a $200,000 home are 1% of its value or $2000. You could deduct about half of that amount against ordinary income in the tax year it was paid (County Fiscal Year begins July 1 st).

3. Energy Tax Credits

Solar panels are ONE of the qualifying tax credits for energy efficiency.

Changes and home improvements that qualify as energy credit can also earn you an additional tax break as a homeowner. Solar panels, solar-powered water heaters, home insulation, exterior doors and electric heat pumps are a few energy efficient upgrades that may be eligible as tax credits. A few are set to expire at the end of 2016 and have stipulations so check with Energy Star to see if your eco friendly renovations apply.

4. Annual Adjusted Housing Costs

Referring back to the previous example: When applying the mortgage interest deduction ($9000) plus the property tax deduction ($1000) against the annual gross housing cost ($12,000), net housing costs now total about $2000 per year. In an appreciating market, that $2000 housing cost could be offset by increased property value and/or equity build up. Additionally, every year you pay down your mortgage you’re also building up equity in your home. ONE important thing to consider is that, all situations are different. The discussion above is designed to be a very simplified example of some of the financial benefits of owning a home versus renting. Buying a house is a huge economic decision and doing so without the aid of a realtor is considerably risky. Consult a professional to give you the best analysis when it comes to providing tax breaks for your housing situation.

Hoopes and Norton

702.340.1545